What is Fraud and Abuse?

What is Fraud?

Medicare Fraud assumes criminal intent. Intentional billing for services that were not received or were billed at a higher rate than is actually justified is Medicare fraud.

The most frequent kind of fraud relates to entitlements or payments under the Medicare program.

Examples of Fraud

Some examples of common types of fraud include:

- Billing for services, supplies or equipment not provided

- Billing for excessive medical supplies

- Obtaining or giving a Medicare number for “free” products or services

- Improper coding to obtain a higher payment

- Unneeded or excessive x-rays and lab tests

- Claims for services that are not medically necessary

- Using another person’s Medicare number, or letting someone else use your number

- Soliciting, offering or receiving a kickback, bribe or rebate (for example, paying for a referral of patients)

- Provider completing Certificates of Medical Necessity (CMN) for patients not professionally known by the provider

- Suppliers completing a CMN for the physician

- Using another person’s Medicare card to obtain medical care

- Imposter scams including unsolicited calls, texts, or emails from someone posing to be from Medicare, offering free services or products. Imposters may also ask you for your Medicare number or to confirm your Medicare number.

What is Abuse?

Abuse occurs when providers supply services or products that are not medically necessary or that do not meet professional standards.

Examples of Abuse

Some examples of common types of abuse include:

- Excessive charges for services or supplies

- Claims for services that are not medically necessary

- Breach of the Medicare participation or assignment agreements

- Improper billing practices

- Billing Medicare at a higher fee schedule rate than for non-Medicare patients

- Submitting bills to Medicare where Medicare is not the beneficiary’s primary insurer

Possible Outcomes of Fraud or Abuse

If determined to be a billing error, processing error and/or other misunderstanding, appropriate action is taken

Potential or referral to the Office of Inspector General (OIG)

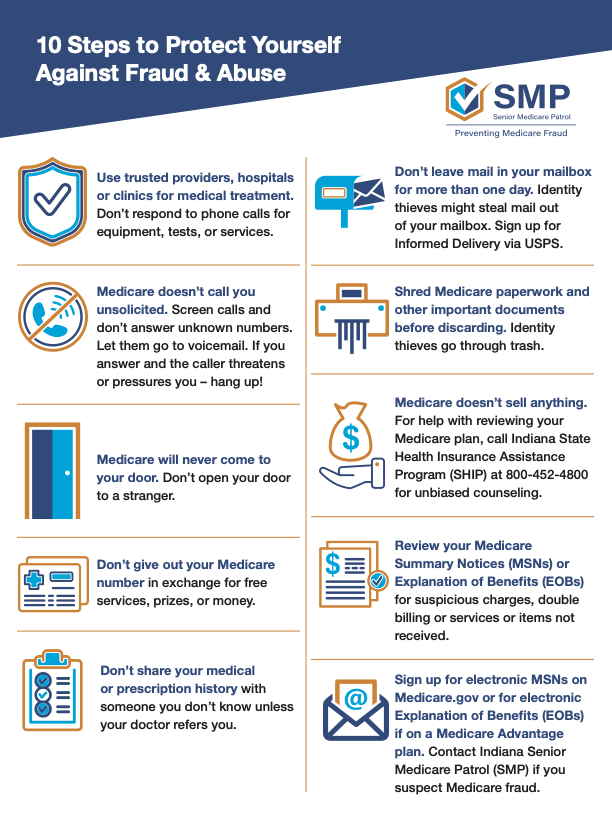

10 Steps to Protect Yourself Against Fraud & Abuse

Need to report suspected fraud? Click here to learn more.